In today's digital age, managing personal finances effectively is crucial for achieving financial stability and growth. The Mint app has long been a favorite among users for budgeting and tracking expenses, but it may not suit everyone's needs. As users search for alternatives, this article will explore various options that can help you take control of your financial health without relying solely on Mint. Whether you're looking for more robust features, enhanced security, or a simpler interface, there’s something out there for everyone.

As we delve into the world of personal finance apps, we will examine several alternatives to Mint, highlighting their unique features, pros and cons, and what makes them stand out. By the end of this article, you will have a comprehensive understanding of your options and be better equipped to choose the best app for your financial needs.

So, if you're ready to explore what to use instead of the Mint app, keep reading as we uncover the top alternatives that can help you manage your finances more efficiently.

Table of Contents

- Overview of Personal Finance Apps

- Top Alternatives to Mint App

- 1. You Need a Budget (YNAB)

- 2. Personal Capital

- 3. Truebill

- 4. Expensify

- 5. Spendee

- 6. PocketGuard

- 7. Clarity Money

- 8. GoodBudget

- Conclusion

Overview of Personal Finance Apps

Personal finance apps have gained immense popularity over the years, offering users an efficient way to track expenses, create budgets, and plan for future financial goals. These apps can sync with bank accounts, credit cards, and other financial institutions, making it easier for users to gain insights into their spending habits.

While the Mint app is one of the most well-known platforms, there are numerous alternatives available, each catering to different financial needs and preferences. Whether you are a meticulous budgeter, a casual spender, or someone looking to invest, exploring these alternatives can help you find the perfect fit for your financial journey.

Top Alternatives to Mint App

1. You Need a Budget (YNAB)

YNAB is a popular budgeting app that takes a proactive approach to managing finances. Unlike Mint, which focuses on tracking past spending, YNAB encourages users to allocate every dollar they earn to specific expenses or savings goals.

- Key Features:

- Real-time budget tracking

- Goal setting and tracking

- Comprehensive financial education resources

- Pros:

- Helps users develop better budgeting habits

- Encourages financial accountability

- Cons:

- Monthly subscription fee

- Steeper learning curve for new users

2. Personal Capital

Personal Capital is an excellent choice for those looking to combine budgeting with investment tracking. This app allows users to manage their finances holistically by providing insights into spending habits while also offering tools for retirement planning and investment management.

- Key Features:

- Investment tracking and analysis

- Retirement planning tools

- Net worth tracking

- Pros:

- Comprehensive financial overview

- No monthly fees for basic features

- Cons:

- Investment-related features may not appeal to everyone

- Aggressive marketing for financial advisory services

3. Truebill

Truebill focuses primarily on managing subscriptions and recurring bills, making it an ideal choice for users who want to cut down on unnecessary expenses. The app helps users identify subscriptions they may have forgotten about and facilitates cancellations if desired.

- Key Features:

- Subscription tracking and management

- Automated bill negotiation

- Budgeting tools

- Pros:

- Helps users save money by identifying unused subscriptions

- User-friendly interface

- Cons:

- Limited budgeting features compared to other apps

- Some features require a subscription

4. Expensify

Expensify is a robust expense tracking app that is ideal for business travelers and freelancers. It allows users to easily track expenses, upload receipts, and generate expense reports.

- Key Features:

- Receipt scanning and expense tracking

- Customizable expense reports

- Integration with accounting software

- Pros:

- Great for business and tax purposes

- Mobile and desktop compatibility

- Cons:

- Monthly fee for premium features

- May be too complex for casual users

5. Spendee

Spendee is a visually appealing budgeting app that focuses on simplicity and ease of use. It allows users to create shared wallets for family or friends, making it ideal for group expenses.

- Key Features:

- Shared wallets for group budgeting

- Customizable categories

- Real-time expense tracking

- Pros:

- Intuitive design

- Great for tracking shared expenses

- Cons:

- Limited features in the free version

- Some users may prefer more advanced tools

6. PocketGuard

PocketGuard is a budgeting app that simplifies financial management by showing users how much disposable income they have after accounting for bills, goals, and necessities. This makes budgeting easier and more accessible.

- Key Features:

- Real-time tracking of income and expenses

- Automatic categorization of spending

- Goal setting for savings

- Pros:

- Simple and straightforward interface

- Helps users avoid overspending

- Cons:

- Limited investment tracking features

- Subscription fee for premium features

7. Clarity Money

Clarity Money is designed to help users manage their money by providing insights into spending habits and offering tools to save. The app can help users cancel unwanted subscriptions and create budgets based on their financial goals.

- Key Features:

- Subscription management

- Budgeting tools

- Credit score monitoring

- Sophie Rain Naked

- Hudson County Correctional Facility

- Stream Wwe

- Dr Phil Donald Trump

- Molly Roloff Kids

- Sophie Rain Spiderman Erome

- Carol Luistro Obituary

- Sam Marrazzo

- Ticket Vs Citation

- Bruce A Piekarsky

Sight Words for Second Graders Shared Teaching

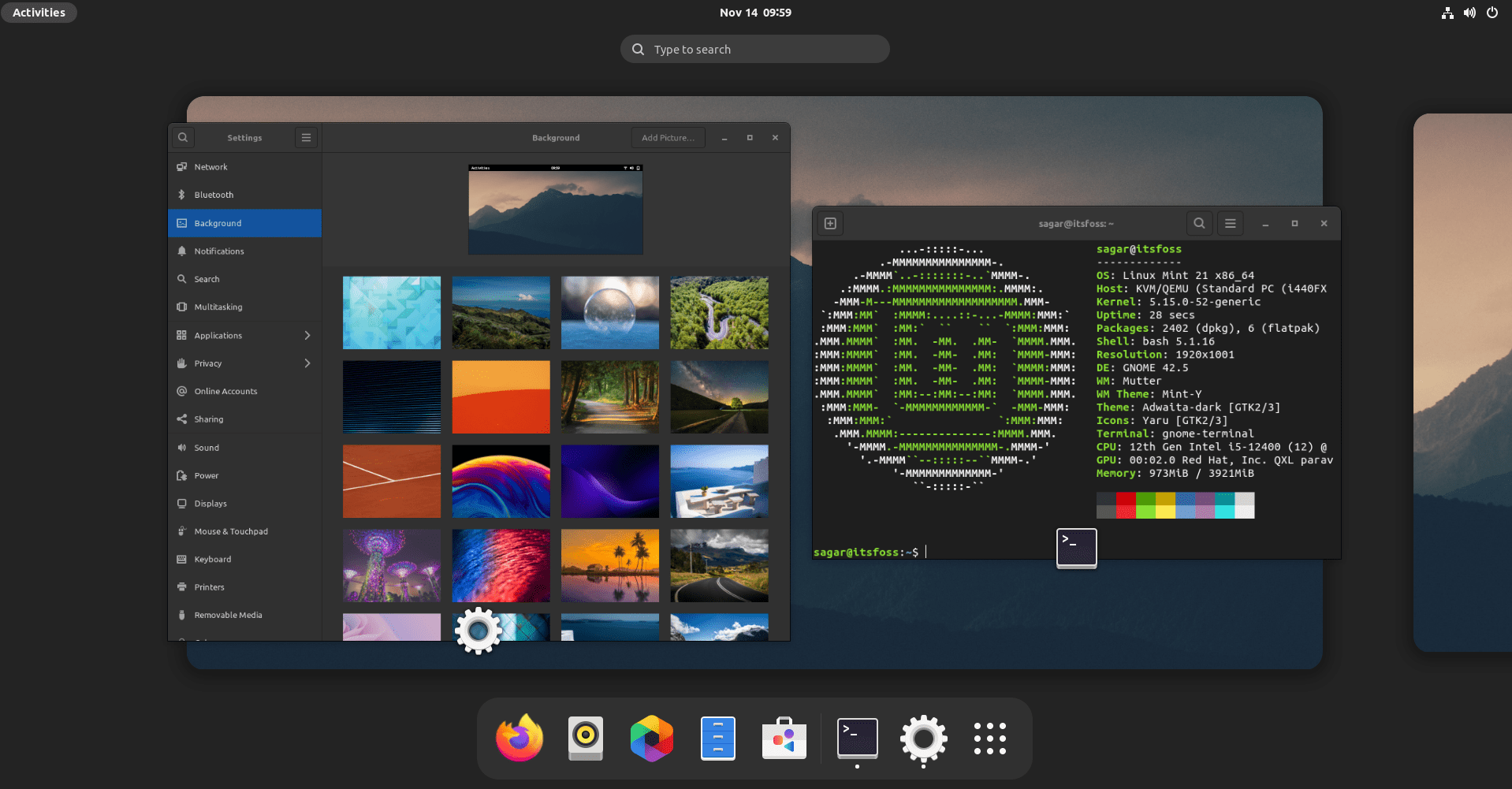

How to Install GNOME Desktop Environment in Linux Mint

Baptism Party Decorations, Party Table Decorations, Baby Shower